StoneCreek Partners acts as a family office real estate advisors, working directly with family office representatives as well as with representative attorneys and accountants. Our family office consultancy includes high net worth investors including performing artists. Because of our additional entertainment industry experience, we also get involved supporting clients having brand management and licensing issues.

Real Estate Acquisitions Due Diligence

Our firm’s expertise as family office real estate advisors begins with real estate investment due diligence, whether land or property acquisitions, joint ventures, or limited partnership interests. We have managed the outsourced acquisition screening and initial investment suitability assessments, for family offices and other investors that wish to streamline their in-house operations and place acquisitions with an outside expert. Our expertise spans commercial real estate, hotels and resorts, and location-based entertainment.

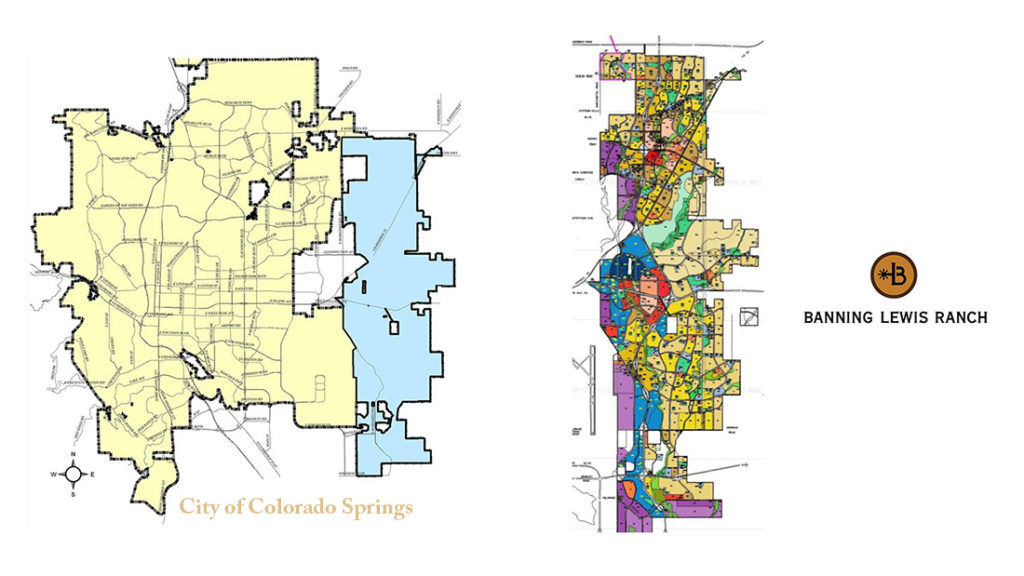

We have also been involved in major master-planned community acquisition, planning, and development, such as the Banning-Lewis Ranch (described below).

While helming the family office real estate portfolio of Newfield Enterprises International, our firm’s co-founder advised the acquisition of Banning-Lewis Ranch from the Resolution Trust Corp. NEI acquired the 21,400-acre ranch for $18.5 million which the Saudi family resold after a short hold for $55 million. Developer Frank Aries had originally acquired the ranch for $92 million from Mobile Land but ultimately defaulted on loan payments.

Property Dispositions

We also handle discrete asset dispositions, sometimes directly arranging for the acquiring third-party. We recently arranged for the acquisition of a major Coastal California landholding by a sovereign wealth fund for a closely-held family enterprise interested in the sale of the asset.

Real Estate Asset Management

From a real estate asset management standpoint, we take either the asset management role “managing the managers,” or, we take the direct property (or facilities) management role. We taken on the role of development project managers, from feasibility and design, through construction and pre-opening matters. Our Managing Director was a co-founded of the Hotel Asset Manager’s Association, participating in the early days of that organization when a half-dozen Ritz-Carlton Hotel asset managers got together as a means to discuss luxury hotel operating issues.

In all of work we are pleased to consult in limited matters, to provide advice on a particular subject. We are also available to act as the responsible owner’s rep for a matter, handling acquisitions, dispositions, and negotiations of deals on behalf of the family office. We certainly enjoy taking the lead when asked.

We are not registered investment advisors. StoneCreek Partners is a real estate consultancy that’s been in operation since 1984 and through predecessor companies some years before that. From time to time, our co-founder has taken leaves of absence to take a leadership role in turning around a family asset with real estate workout issues, and, with NBCUniversal’s Parks and Resorts group where he was asked to lead a location-based entertainment in the early days of that industry.

Personal Service, Always Discrete

We are accustomed to the extended services and availability that such clients require from time to time.