Real estate asset classes – the latest, provides our tracking of major asset types, industry players, and the latest transactions by class. By definition our tracking pertains to real estate-based assets, and not to the other major asset classes such as stocks, bonds and cash.

Most real-property based businesses are part of one real estate asset class or another. Commercial real estate, hospitality, logistics, industrial, and the like. There a many different ways to invest in real estate: directly through a partnership or limited liability company (LLC), through shares in a real estate investment trust (REIT), in shares of a company whose value is based upon real estate, and through various mutual fund investment vehicles.

Real estate asset classes and their relative valuations are directly related to consumer preferences and broad economic performance, among other factors. During 2020, investors have observed large changes in end-user preferences for various real estate, including the behavior effects of Covid-19 safety and shutdown requirements. As one example is the sensibilities about “work from home,” which has now been experienced by millions of employees as well as increasingly accepted by employers. This behavioral change is impacting the office space market, and co-working sector specifically, in a large way and the impact may be lasting.

Investors, facility operators, local municipalities, and consumers, are having a busy year recalculating the fundamentals of operating real estate assets.

The Covid-19 pandemic has expedited changes already underway in the various asset classes, and, has exposed weaknesses in some real estate types that have been unable to cope with the virus’ impact.

Of course, some inherent weakness in select place-products has been heightened by the financial leveraging that is typical. Looking ahead, we may see investors and facilities management companies increase (retained) operating reserves to be in a better financial position during any future pandemic or global calamity.

Our tracking, real estate asset classes – the latest, certainly suggests this differential Covid impact among asset types.

We track the following asset classes, as a helpful means for our clients to stay current with best-practices and emerging players:

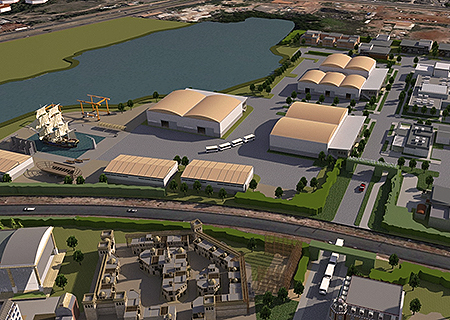

- Tech-enabled Office and Industrial, such as science and technology parks, data centers, cold chain, life sciences, and film production facilities

- Office, general-purpose

- Industrial, general purpose but also including specialized self-storage

- Retail, including lifestyle retail centers, c-store fuel stations, and retailers as pertains to each retail category

- Hotels and resorts, including glamping and eco-tours

- Residential, including senior housing and care

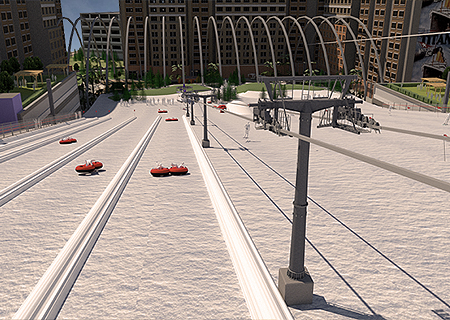

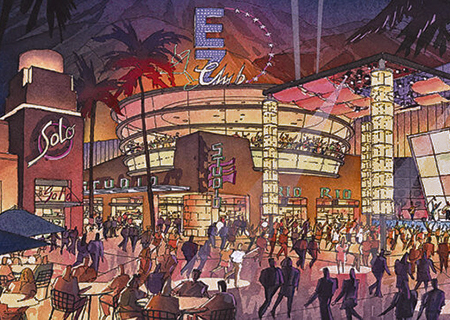

- Attractions, including location-based entertainment and man-made ski & snow venues

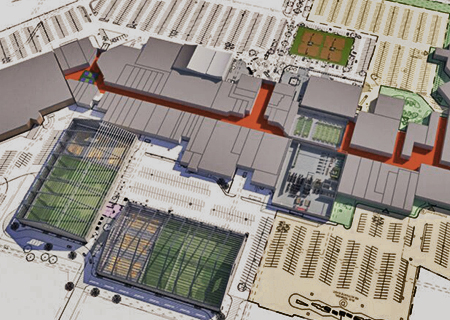

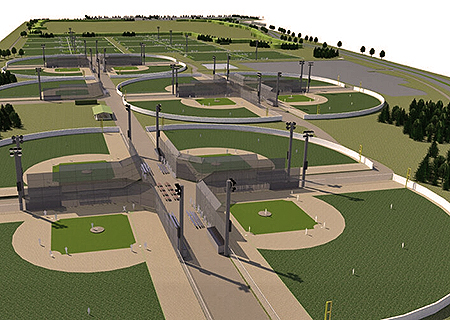

- Recreation sports, including sports mega-complexes

- Outdoor recreation

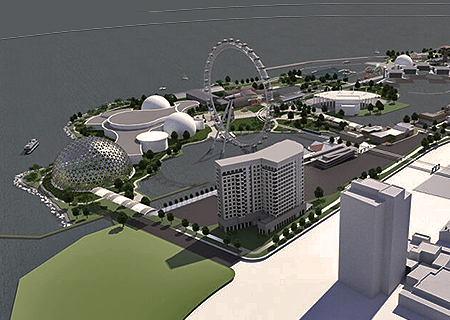

- Mega projects, particularly mixed-use including major redevelopment and adaptive-re-use projects

Detailed information about real estate asset classes – the latest, is available at the links listed below. Our tracking information as provided here is in continuous updating and refinement. We’ll appreciate any suggestions or new you may wish to share. Thank you for that.