Senior Housing Occupancy Increased in 4th Quarter

Senior housing occupancy increased in the U.S., in the 4th Quarter of 2022, according to data from the National Investment......

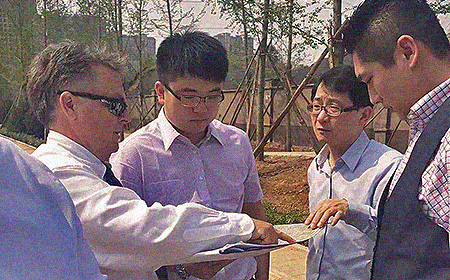

Real estate advisors supporting clients throughout the world, since 1994. We represent owners for asset management, transactions, design-development, and acquisitions due diligence.

Our advisory work is based upon our direct industry experience developing and operating commercial real estate, hotels, and entertainment projects and facilities. We provide due diligence and feasibility analysis for acquisitions and to-be-built developments, and represent owners in design-development management and asset management.

We act as U.S. real estate advisors providing feasibility and due diligence services for real estate, entertainment, and hotel/hospitality properties. We work with private investors, lenders, and government entities involved in real estate acquisitions, dispositions, as well as development and redevelopment (regeneration). We frequently act as an extension of Owner’s organization, managing particular development projects and real estate acquisition programs.

StoneCreek Partners represents clients in completing transactions and other dealmaking related to project implementation. This includes financing arrangements, and anchor tenant solicitation, as well as entitlement and permit processing. For master planned communities we have supported builder pad sales and BtoB sales programs for specific facility types.

StoneCreek Partners represents client organizations as U.S. real estate advisors in an “owner’s rep” capacity, whether for managing an acquisitions program, an economic development effort, asset or facilities management, or design-development of a new projects. Our expertise in this role includes luxury hotels, marinas, golf courses, entertainment venues. and retail-entertainment projects.

StoneCreek Partners often takes a real estate, hotel, or entertainment project project forward following initial feasibility or due diligence analysis. On behalf of Owner we organize overall implementation including project team formation including general contractor and specialty trades. Some of our real estate advisor-related work involves franchise selection, tenant leasing, sponsor, fuel supply deals, and other such arrangements.

StoneCreek Partners is supported by Adventure Entertainment Cos. (“AEC”) in pursuing various creative matters. AEC is an affiliate of, and partially owned, by SCP. AEC often joins with SCP client projects in supporting rapid-prototyping during feasibility evaluations, and providing conceptual design for new products and development projects.

Senior housing occupancy increased in the U.S., in the 4th Quarter of 2022, according to data from the National Investment......

The Adventure Entertainment Cos., an affiliate of StoneCreek Partners (“SCP”), has launched a new website at AEC Creative – in....

President Biden signed legislation today with the effect that the EB-5 program is reauthorized, in particular its Regional Center component,......

Sustainable Environment Associates (SEAS) and Adventure Entertainment Cos. have launched GoBOLD Adventures™, an adventure recreation design-bui...