Golf Courses Remain a Focus for Redevelopment

Golf courses remain a focus for redevelopment and repurposing as property owners explore greater highest-and-best use for their golf assets.

The interest in such redevelopment is straight-forward. Golf courses were overbuilt in the U.S. and in some global regions, and the 2008 recession decimated many golf owner’s financial resources. At the same time golf participation has steadily declined year over year, at least through 2019 (there is an exception in 2020 due to Covid-19). With this confluence of economic difficulties and ever-changing consumer preferences for their leisure-time activities, in many instances golf course assets offered a tantalizing opportunity for adaptive re-use and repurposing. For many cities and communities with increasing interest in local economic development and specific agendas such as affordable (if not more inclusionary) housing, these golf assets are particularly ripe for highest-and-best-use consideration.

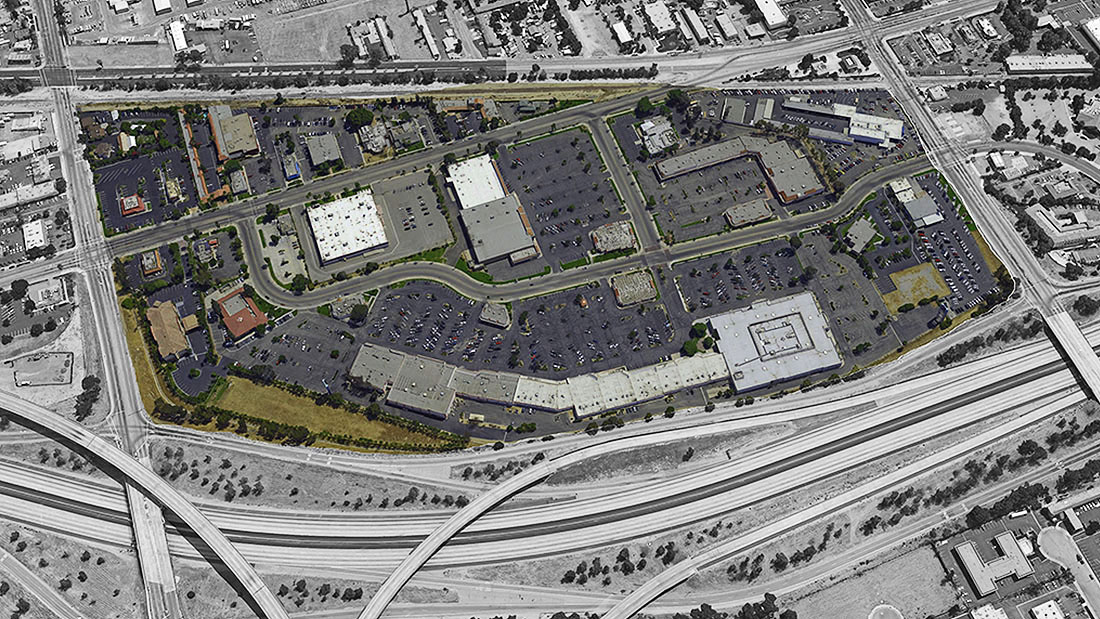

The mega project proposed by Hines for Riverwalk Golf Course in San Diego, will likely spur even greater interest in golf course redevelopment. Golf courses are often situated within attractive residential communities, with reasonable roadway access and ingress/egress for feasible re-purposing as residential projects. Hines found such an opportunity with the Riverwalk site in a decidedly “best case” way – the Riverwalk golf course just happens to be so well-located within its region that it can support substantial mixed-use redevelopment. Hines has proposed such a mega redevelopment project there, which could see in excess of $1 billion in new development.

For more information about golf course redevelopment, we have started tracking such projects as part of our ongoing client project research. We expect golf courses to remain a focus for redevelopment, for some time to come. StoneCreek Partners also tracks other major real estate asset classes, with some of our research and tracking published here online. The link is available here:

Golf Course Redevelopment – the Latest